What We Do

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

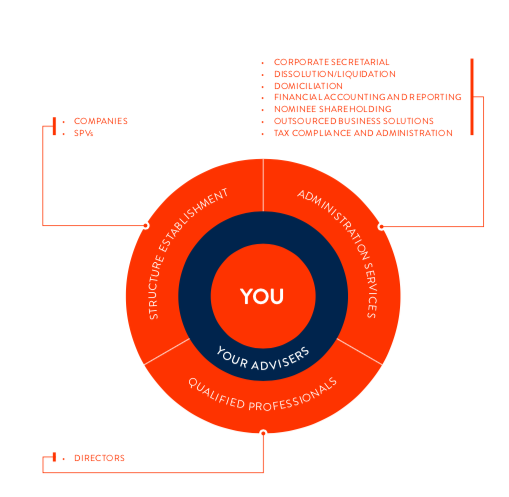

What We Do

Private wealth

Whether you are an entrepreneur, an investor in private capital or a member of a multi-generational family you will have unique requirements and prerogatives. Our journey with you begins by dedicating time to understanding your needs and then working with you and your advisors to formulate and implement a solution. Our client-centric approach gives you peace of mind knowing that you can rely on our in-depth knowledge and support at every stage of your wealth planning.

Corporate

- We have assisted private equity clients with the structuring of M&A deals including the financing and banking arrangements inherent in these deals.

- You may be embarking on a new venture and require support in terms of establishing operations as a start-up. We can support you by providing a tailored outsourced business solution that meets your needs. Our solution includes the provision of general administration services, assistance with bank account opening, secondment of employees, administration of staff payroll and other bespoke services.

Case Study

Structuring overseas real estate investment through a Malta Holding Company

This Guidance note is designed to provide some basic information regarding some of the key features, benefits and other considerations arising from structuring a Portfolio of Real Estate investments through a Malta Holding company.

Frequently Asked Questions

How does one constitute a Malta Company?

Companies and other forms of commercial partnerships are formed by agreement between shareholders or members which agreement is articulated in the Memorandum and Articles of Association.

In comparison to other options for conducting a business activity (a sole trader or partnership for instance) the company provides limited liability to the shareholders with liability being limited to the amount unpaid on the company’s issued called up share capital.

What is the principal difference between a Private and a Public Company?

Companies may be constituted as private or public companies. A private company is one that, in its constitutive document, restricts the rights to transfer shares, limits the number of its members to fifty and prohibits any invitation to the public to subscribe for any shares or debentures of the company. A private company can further be established as a private exempt company or a single member private exempt company. By exclusion, a public company is defined as a company that is not a private company.

What is the minimum share capital requirement for a Malta Company?

Private Company: the minimum share capital is of €1,165, of which at least 20% has to be paid up.

Public Company: the minimum share capital is of €44,588, of which at least 25% has to be paid up.

What currency must the share capital be denominated in?

Capital may be denominated in any foreign convertible currency which is then the reporting currency of the company. Tax is also paid in the company’s reporting currency.

The relevant amount must be deposited in a bank account under the name of the company in formation. The deposit slip should then be presented to the Malta Business Registry as proof of the deposit of capital at incorporation stage.

How does one constitute a Malta Company?

Companies and other forms of commercial partnerships are formed by agreement between shareholders or members which agreement is articulated in the Memorandum and Articles of Association.

In comparison to other options for conducting a business activity (a sole trader or partnership for instance) the company provides limited liability to the shareholders with liability being limited to the amount unpaid on the company’s issued called up share capital.

What is the principal difference between a Private and a Public Company?

Companies may be constituted as private or public companies. A private company is one that, in its constitutive document, restricts the rights to transfer shares, limits the number of its members to fifty and prohibits any invitation to the public to subscribe for any shares or debentures of the company. A private company can further be established as a private exempt company or a single member private exempt company. By exclusion, a public company is defined as a company that is not a private company.

What is the minimum share capital requirement for a Malta Company?

Private Company: the minimum share capital is of €1,165, of which at least 20% has to be paid up.

Public Company: the minimum share capital is of €44,588, of which at least 25% has to be paid up.

What currency must the share capital be denominated in?

Capital may be denominated in any foreign convertible currency which is then the reporting currency of the company. Tax is also paid in the company’s reporting currency.

The relevant amount must be deposited in a bank account under the name of the company in formation. The deposit slip should then be presented to the Malta Business Registry as proof of the deposit of capital at incorporation stage.

Nissim Ohayon

Founder and Managing Director. Abie International

Having started his career at PricewaterhouseCoopers in 1996, Nissim has in-excess of 24 years of experience in the financial services space having worked in the Channel Islands and Malta. In the Channel Islands he was a Director of a leading fund administration business with responsibility for a portfolio of alternative fund clients. In Malta he later set up and managed a Corporate, Fiduciary and Fund Administration business for a leading international financial services group and has extensive experience in assisting clients and their advisors with establishing and providing ongoing support to Private client and Corporate structures. He has also in-depth experience in the private equity space having structured and sat on the Boards of a number of Private Equity investment and fund raising vehicles.

Would you like to talk?

Ut porttitor imperdiet hendrerit. Suspendisse pulvinar lacus nec sollicitudin finibus ligula quam bibendum dui, maximus ornare ex nulla ut lacus.

Location

The Cornerstone Complex

Level 1 Suite A

16 September Square

Mosta MST 1180

Malta

Contact

T. +356 2247 0500

F. +356 2247 0560

nohayon@abieinternational.com.mt